7 year arm calculator

Inflation Rate at 75 Hits 40-Year High. Mortgage calculator and an estimate of a 71 ARM starting at 380 your principal and interest payment will be 652.

7 1 Arm Calculator 7 Year Hybrid Adjustable Rate Mortgage Calculator

1 Patients are considered to be at elevated risk if the Pooled Cohort Equations predicted risk is.

. The now retired 71 ARM loans were based on a benchmark known as LIBOR London Inter-Bank Offered Rate that will cease to be published by 2023. If no results are shown or you would like to compare the rates against other introductory periods you can use the products menu to select rates on loans that reset after 1 3 5 or 10 years. 10-year ARM rates vs.

Therefore if youre planning on using a 71 ARM its essential to know your finances. Below you will find current and historical weekly yields for 3 month 6 month Treasuries as well as values for 1- 2- 3- 5- 7- 10- 20- and 30 year treasuries. As adjustable-rate mortgages these loans share many design features and appeal to many of the same borrowers.

A 30-year fixed-rate mortgage at 400 would cost you 668 per month. Cost of living comparison calculator. The following table shows the rates for ARM loans which reset after the seventh year.

By default refinance loans are. The average APR on a 15-year fixed-rate mortgage remained at 4951 and the average APR for a 5-year adjustable-rate mortgage ARM fell 1 basis point to 5305 according to rates provided to. 51 ARM - Similar to the 71 ARM but the interest rate can change after 5 years.

The now retired 31 ARM loans were based on a benchmark known as LIBOR London Inter-Bank Offered Rate that will cease to be published by 2023. To use it just enter any two dates from 1913 to 2022 an amount and then click Calculate. This US Inflation Calculator measures the buying power of the dollar over time.

Treasury Securities T-Secs also known as TCM or CMT or T-Sec values are calculated by the Treasury Department and reported by the Federal Reserve in Publication H15. Some interest rates can increase by a few percentage points. There are many types of ARMs but this spreadsheet provides a way to calculate estimated payments for a Fully Amortizing ARM the most common type of ARM.

1 year ARM refi. Inflation Rises 7 in 2021 Marking Highest Rate Since 1982. A 31 ARM or adjustable-rate mortgage is a type of 30-year mortgage that has a fixed interest rate for the first three years and an adjustable or variable interest rate for the remaining 27.

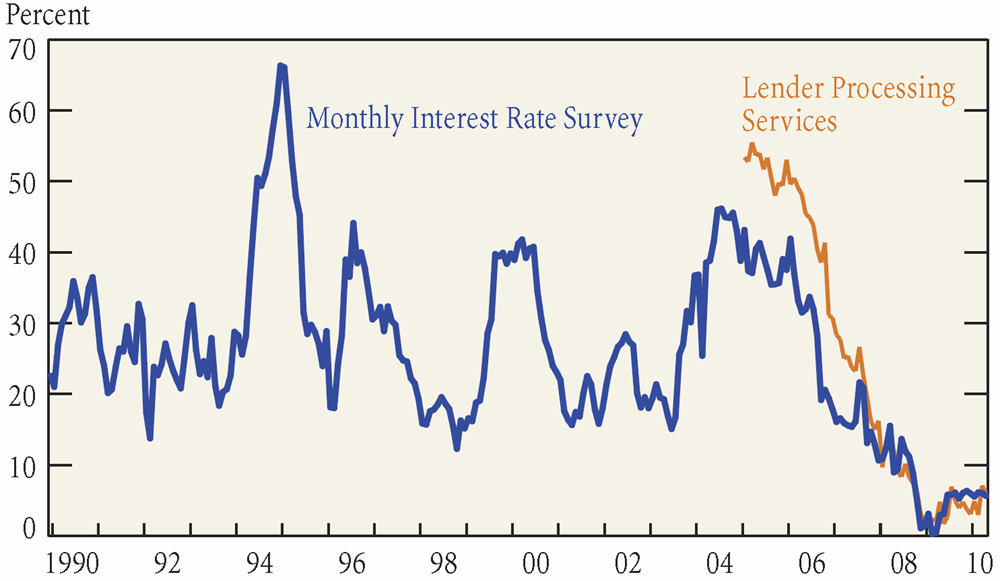

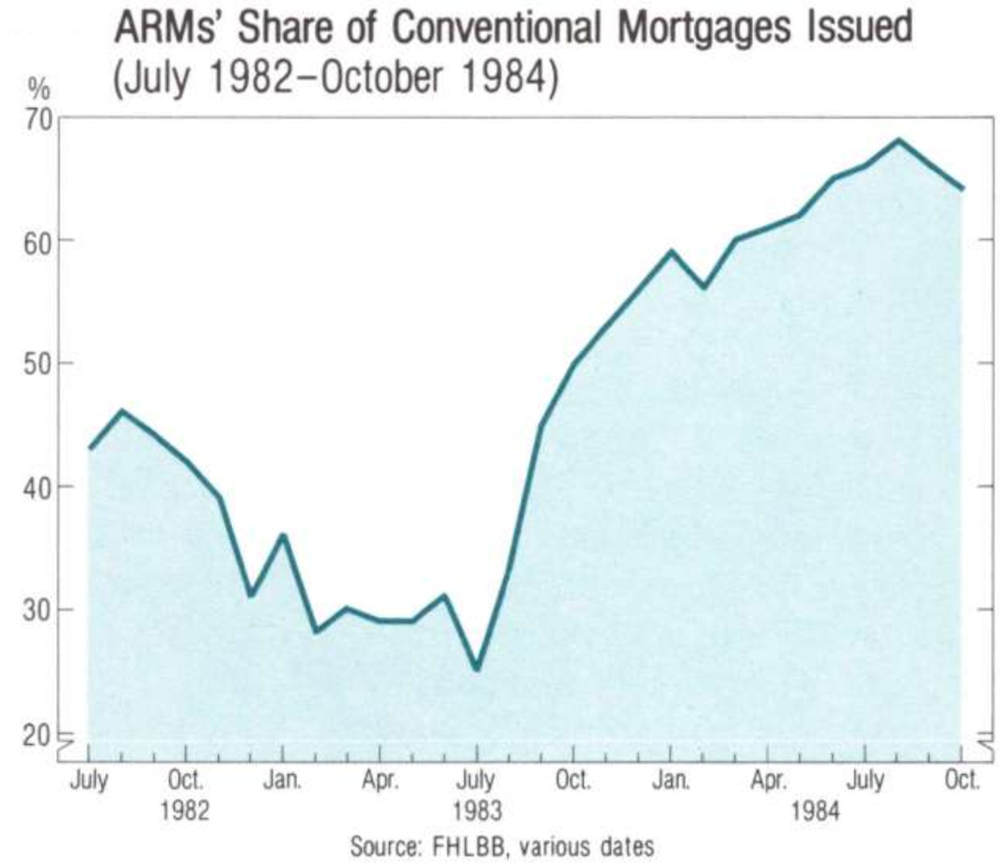

This calculator defaults to a 15-year loan term and figures monthly mortgage payments based on the principal amount borrowed the length of the loan and the annual interest rate. VA loan - 30-year fixed-rate for qualifying veterans and active military. Around 61 percent of the market share accounted for other types of mortgages.

A 10-year ARM provides more stability but less upfront purchasing power than a 7-year ARM. ARM that represented 27 percent of new originations. A home affordability calculator can also be helpful in determining affordability.

If no results are shown or you would like to compare the rates against other introductory periods you can use the products menu to select rates on loans that reset after 1 5 7 or 10 years. As an example consider a 51 ARM. A 31 ARM used to be a type of 3-year adjustable-rate mortgage where the interest rate was fixed for the first 3 years and then adjusted annually for the remainder of its term.

Current 3-Year Hybrid ARM Rates. Also a great option if you want to put down a smaller down payment. 31 ARM refi.

Current 7-Year Hybrid ARM Rates. This peer-reviewed online calculator uses the Pooled Cohort Equations to estimate the 10-year primary risk of ASCVD atherosclerotic cardiovascular disease among patients without pre-existing cardiovascular disease who are between 40 and 79 years of age. By default refinance loans are displayed.

After that the interest rate can adjust at a frequency of once per year. A 71 ARM used to be a type of 7-year adjustable-rate mortgage where the interest rate was fixed for the first 7 years and then adjusted annually for the remainder of its term. The following table shows the rates for ARM loans which reset after the third year.

A 51 ARM means the interest rate remains fixed for 5 years 60 months. FHA 30-year fixed - Best for homebuyers with lower credit scores.

Back End Debt To Income Ratio Debt To Income Ratio Debt Ratio Debt

Excel Payment Schedule Template Inspirational Amortization Schedule Calculator Amortization Schedule Excel Templates Spreadsheet Template

7 1 Arm Calculator 7 Year Hybrid Adjustable Rate Mortgage Calculator

Arm Calculator Free Adjustable Rate Mortgage Calculator For Excel

7 1 Arm Calculator 7 Year Hybrid Adjustable Rate Mortgage Calculator

Now That You Have A Good Idea On Where Rates Are Use Our Mortgage Calculators To See If You Qualify See If You Qualify Her Mortgage Mortgage Rates Calculators

Calories Burned Calculator Calories Burned Calculator Calorie Workout Burn 500 Calories Workout

How To Create A Mortgage Calculator With Microsoft Excel Mortgage Amortization Calculator Mortgage Refinance Calculator Mortgage Loan Calculator

7 1 Arm Calculator 7 Year Hybrid Adjustable Rate Mortgage Calculator

Mortgage Calculator Loans For Poor Credit Mortgage Mortgage Calculator

7 1 Arm Calculator 7 Year Hybrid Adjustable Rate Mortgage Calculator

![]()

Arm Calculator Free Adjustable Rate Mortgage Calculator For Excel

Iran Conflict Influences Drop In Mortgage Rates Fixed Rate Mortgage Mortgage Rates 30 Year Mortgage

Pin On Exercise

Pin By Don Crozier Sr Mortgage Advi On Mortgage Rate History Mortgage Rates 15 Years Mortgage

Biggest Drop In Decades For Mortgage Rates Mortgage Rates Mortgage Home Buying Tips

7 1 Arm Calculator 7 Year Hybrid Adjustable Rate Mortgage Calculator